What Every MLO Should Know About Comments on a VA Certificate of Eligibility

What Every MLO Should Know About Comments on a VA Certificate of Eligibility

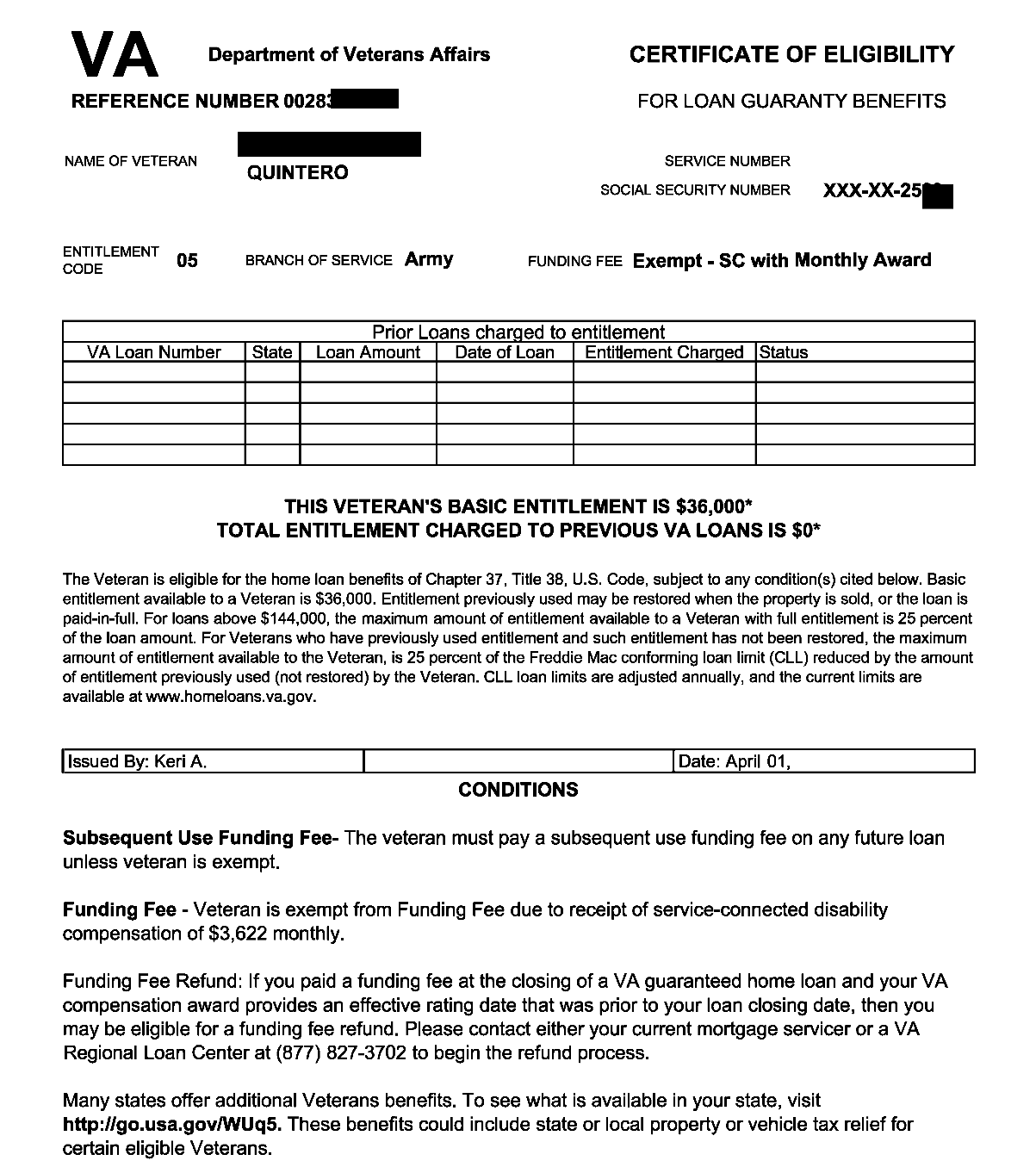

A Veteran’s Certificate of Eligibility (COE) is more than just proof of entitlement—it’s also a roadmap for how you, as the lender, must structure the file. Hidden at the bottom of the COE, you’ll often find comments that can affect underwriting, timelines, or even funding fee exemptions. Two of the most frequent notes that appear are related to Priority Approval and Active-Duty status. Understanding these early can prevent processing delays and compliance issues later in the loan process.

Before diving into those, make it a habit to review the COE thoroughly. Check for:

- Entitlement details and remaining benefit

- Disability information, if listed

- Any comments or conditions in the remarks section

Those small details can determine how you handle the loan from start to finish.

Priority Approval Comments

You’ll often see something like this on the COE:

“This loan must be submitted to VA for prior approval unless it’s an Interest Rate Reduction Refinancing Loan (IRRRL) on a current VA loan that isn’t delinquent.”

When you spot this, it usually means the borrower is receiving income-based VA disability pension. In these cases:

- The VA must review the full loan package before guaranty.

- The review compares the income disclosed on the loan application to what the Veteran reports annually to the VA.

- Expect a review window of up to 10 business days, so identify this early in your process.

- If income discrepancies exist, the VA may determine that the Veteran has been overpaid—potentially resulting in a federal debt that must be resolved.

Bottom line: when you see a Priority Approval note, do not treat it as routine. Identify it during pre-qualification and set borrower expectations for additional review time.

Active-Duty Comments

Another common remark reads something like:

“Valid unless discharged or released subsequent to the date of this certificate. A certification of continuous active duty as of date of note is required.”

This tells you several key things as the loan officer:

- You’ll need a Statement of Service confirming current active-duty status at the time of closing.

- If there’s a pending pre-discharge disability claim, reach out to the Regional Loan Center (RLC) to verify whether a proposed or memorandum rating has been issued.

- A service member with an approved proposed or memorandum rating qualifies for a funding fee exemption.

- However, if the claim hasn’t been finalized before closing, the borrower must pay the funding fee—and there’s no refund later, even if the claim is approved afterward.

In short: verify active-duty borrowers’ claim status early to avoid issues with funding fee exemptions or documentation delays at closing.

The Takeaway for Loan Officers

The remarks section on a COE isn’t filler—it’s guidance from the VA that can alter your workflow, documentation, and borrower expectations. A quick glance could save you days in processing time.

Always make reviewing COE comments a part of your initial file review checklist. It’s one of the simplest ways to stay compliant, manage timelines, and deliver a smooth experience for the Veterans you serve.