Treating Collection Accounts Correctly on VA Home Loans

How Loan Officers Should Address Collection Accounts on VA Loans

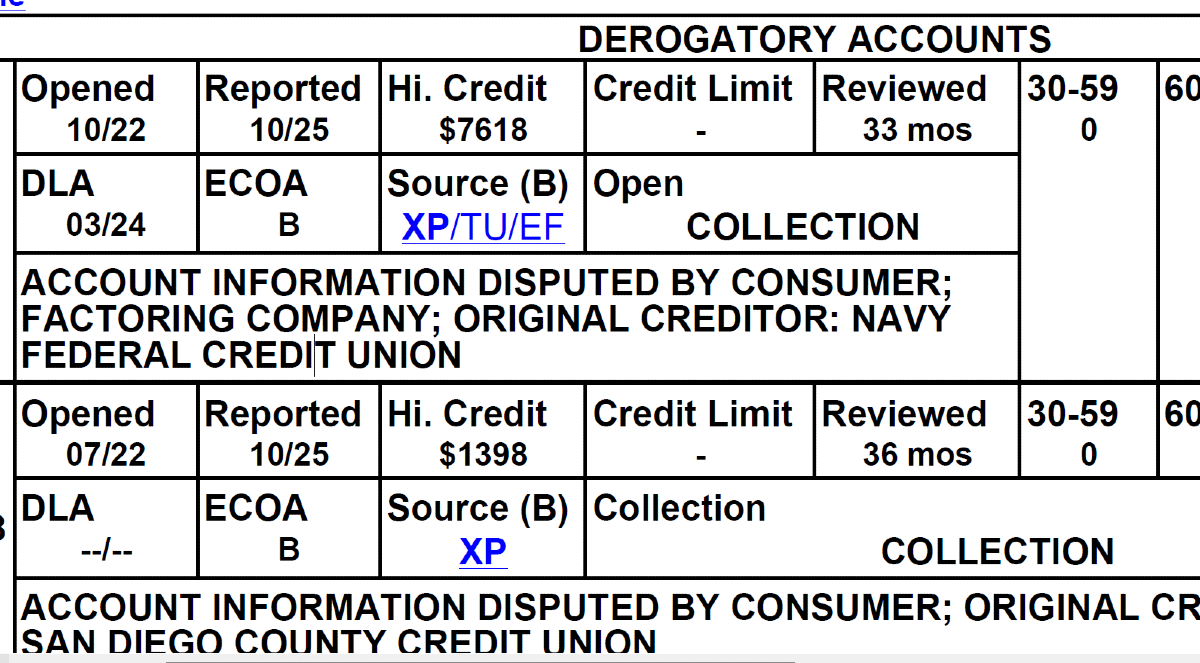

When you’re helping a Veteran client apply for a home loan backed by the United States Department of Veterans Affairs (VA), it’s important to understand how collection accounts factor into underwriting. Unlike many other loan programs, the VA allows more flexibility—but you still must follow specific rules.

Key Points You Should Know

- Isolated collection accounts do not always need to be paid off for a VA loan to move forward.

- For non-medical collection accounts without established payment arrangements, you must include a calculated monthly payment equal to 5 % of the outstanding balance in the borrower’s debt-to-income (DTI) ratio.

- Medical collections (and charge-offs) are treated more leniently: the VA does not require those to be paid off and may not require a formal payment plan.

Why It Matters

The way collection accounts are handled can affect:

- The borrower’s debt-to-income ratio, which in turn affects approval and loan amount.

- Whether the file will pass an automatic underwriting system or require a manual review.

- Documentation needs: you might need to get additional explanations from the Veteran about collection accounts.

What You Should Do in Practice

- Review the credit report early in the process. Identify any collection accounts and note whether they are medical or non-medical.

- If there are non-medical collections without a payment arrangement, calculate 5 % of the outstanding balance and include it as a monthly liability in your underwriting.

- If a payment plan is in place for a collection account, document that arrangement; the underwriter may treat it differently.

- Ensure you gather letters-of-explanation from the Veteran for each collection account: what caused it, whether it’s being addressed, and whether they’ve maintained timely payments elsewhere.

- Communicate with the borrower: let them know how collection accounts will affect their loan and what you’re doing to assess them.

Additional Context for VA Loans & Military Financing

- The VA’s underwriting standards say that lenders should use flexible judgment when assessing credit, debts, and obligations for borrowers using their military-service benefit.

- While the VA doesn’t set a hard maximum DTI for all cases, many lenders use 41 % as a benchmark and look for the required “120%+” residual income when higher DTIs are involved.

- Manual underwriting may be required when borrowers have unique credit issues: collection accounts, recent derogatory events, limited credit history. In those cases, handling collection accounts correctly is even more critical.

Summary

As a loan officer working with Veterans, you can help streamline the process by understanding how the VA treats collection accounts. Non-medical collections without payment plans must be included at 5 % of the balance, while medical collections may not require payoff. Documentations, explanations, and early action will help you present a clean, compliant file and reduce surprises at underwriting.